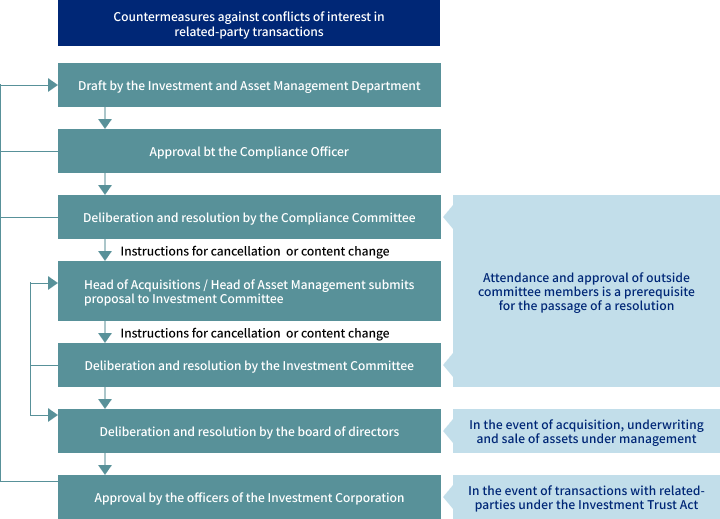

Decision Making Flow Chart for Related Party Transactions

Decisions on related party transactions are subject to the approval of the Asset Manager's Compliance Committee and external board members of the Investment Committee. Furthermore, in certain cases, the Investment Corporation’s Board of Directors approves the matters in accordance with the provisions of the Investment Trust Act.

Earnings-per-unit Linked Asset Management Fee Structure

We apply an asset management fee structure linked in part with earnings-per-unit (EPU).

| Asset Management Fee I | (Operating revenue in the relevant business period - Business expenses related to the real estate leasing business and other businesses + depreciation + loss on disposal of fixed assets) × up to 10%. (as an upper limit) |

|---|---|

| Asset Management Fee II | Amount of profit before income taxes × Adjusted EPU × up to 0.002% (as an upper limit) |

| Asset Management Fee III | Adjusted NAV × NAV per unit for the fiscal period immediately before the relevant business period × up to 0.6% (as an upper limit) |

| Asset Management Fee IV | Sale price when real estate related assets or real estate related loans and other assets are acquired × up to 1.0% (as an upper limit) |

| Asset Management Fee V | Valuation of real estate related assets or real estate related loan and other assets held by a counterparty entity in either a new merger or an absorption type merger × up to 1.0% (as an upper limit) |