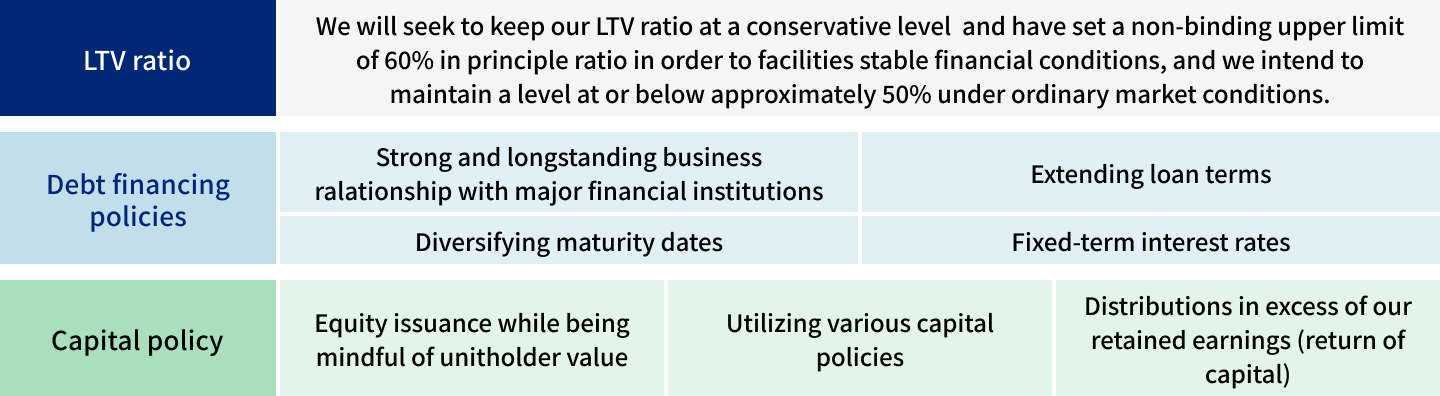

Robust Balance Sheet

We seek to execute a diversified and balanced financing strategy that strengthens our financial structure, while remaining adaptive to changing macroeconomic conditions, in order to produce stable profits over the medium to long term whereby achieving steady growth in the quality of our assets and increase unitholder value.

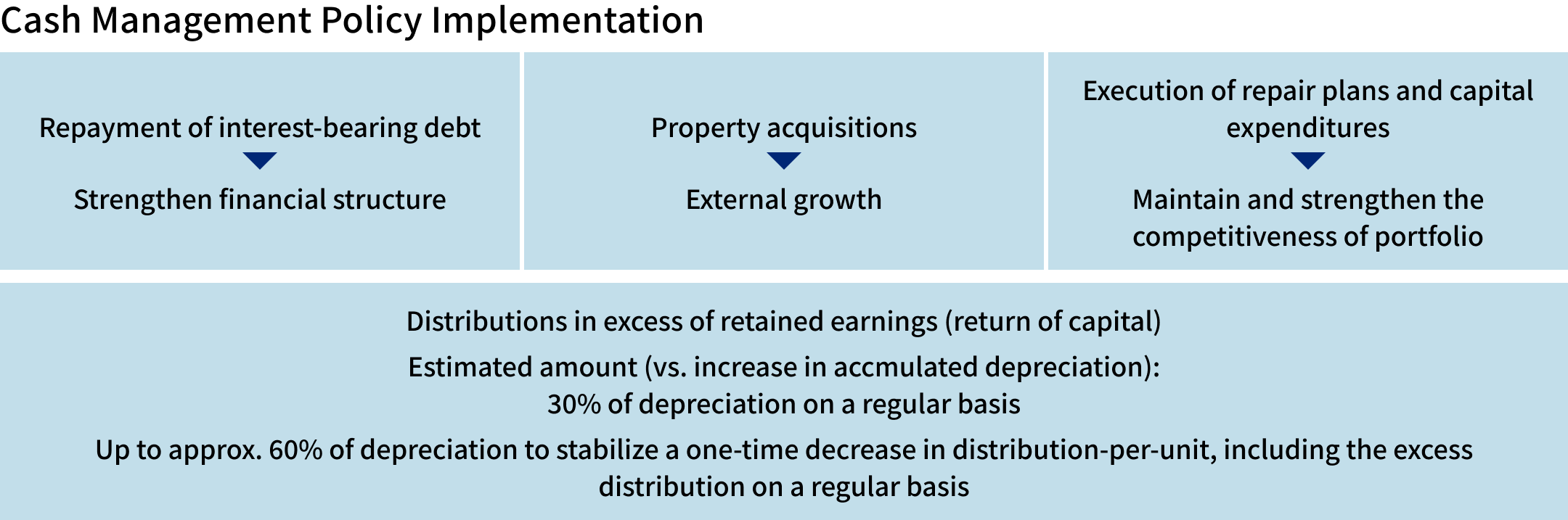

Cash Management Optimization

We believe the amount of capital expenditures actually required for the logistics facilities in our portfolio for each fiscal period will generally be significantly less than the amount of depreciation expense we will recognize with respect to those facilities for each fiscal period. We therefore seek to maximize returns to our unitholders by making distributions in excess of our retained earnings, but we will do so only after carefully considering the macroeconomic environment, trends in the real estate market and real estate leasing environment, the amount of capital expenditures needed to maintain and improve the competitiveness of our portfolio as well as our financial conditions. Specifically, we will aim to distribute on a regular basis an amount equal to approximately 30% of the sum of the accumulated depreciation calculated on the last day of the applicable fiscal period, less the sum of the accumulated depreciation recorded on the last day of the preceding fiscal period, as distributions in excess of our retained earnings. In addition, from time to time, we may also make additional distributions in excess of our retained earnings in order to “stabilize” the effects of certain events that result in a one-time decrease in distributions per unit, including financing events that typically result in the incurrence of one-time extraordinary costs, such as the issuance of new investment units or investment corporation bonds, entering into new borrowings or large scale repair expenditures. In such a case, we aim to make distributions in excess of our retained earnings in an amount up to approximately 60% of the amount obtained by deducting from the sum of the accumulated depreciation calculated on the last day of the applicable fiscal period, the sum of the accumulated depreciation recorded on the last day of the preceding fiscal period.

| (Note) | The portion of the distribution in excess of retained earnings, which represents a return of capital to our unitholders following our voluntary determination to return such capital, is deducted from our unitholders’ tax base for future capital gains calculations. It does not represent a redemption of units, which may be required upon demand by a unitholder of an open-ended J-REIT, as we are a closed-end J-REIT with respect to which unitholders do not have such a right. The standards determined by the Investment Trusts Association, Japan Rules (“ITAJ”) set forth that a closed-end J-REIT, such as us, may distribute up to 60% of the amount obtained by deducting from the sum of the accumulated depreciation calculated on the last day of the applicable fiscal period, the sum of the accumulated depreciation recorded on the last day of the preceding fiscal period in excess of retained earnings as a return of capital. In addition, we do not plan to make distributions in excess of retained earnings to the extent doing so would cause what we refer to as our “appraisal LTV”, as calculated below, to exceed 60%. Appraisal LTV(%) = A/B x 100

|

|---|

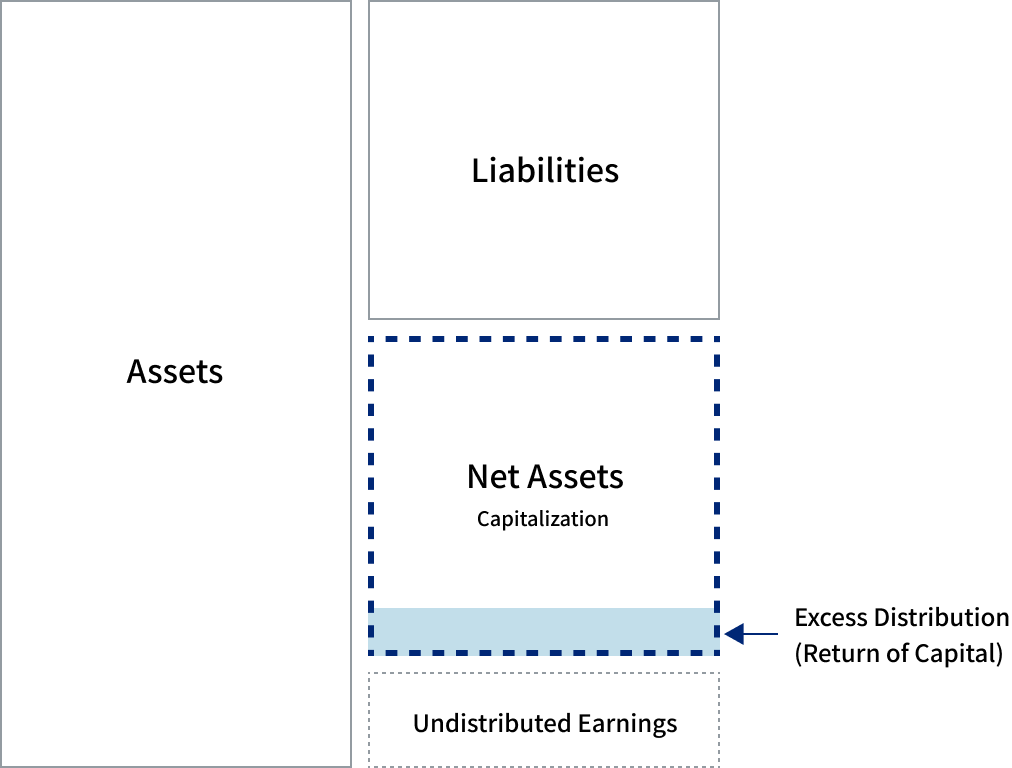

Below is an illustrative diagram of a balance sheet in relation to a payment of excess distributions.

The above diagram is for illustrative purposes only. The amount of distributions in excess of our retained earnings we make is subject to change, and we may not make any distributions in excess of our retained earnings, depending on various factors, such as macroeconomic environment and trends in the real estate market as well as our portfolio status and financial conditions.